Picture appears courtesy of GotCredit. Most retailers and e-tailers, and an increasing number of other businesses, will only purchase from suppliers who will do business via EDI or some other B2B electronic trading platform. Not to worry: this mandate can have tangible benefits for your company too. These benefits are both strategic and operational. B2B electronic capability can strategically give you an advantage by strengthening your relationships with customers and vendors, improving loyalty and long-term alliances. Your “EDI-enabled” business opens the door to increased sales over the same channels – improving your bottom line. In the process, you become more competitive and able to thrive, directly affecting the value of your company.

Operationally, B2B electronic trading reduces both the time and human attention required to complete data entry and order processing. Your integrated capabilities deliver faster order processing with fewer manual errors and faster delivery times which increases customer satisfaction. Decreased operating expenses and improved accuracy in fulfillment and procurement can deliver profits and improve cash flow.

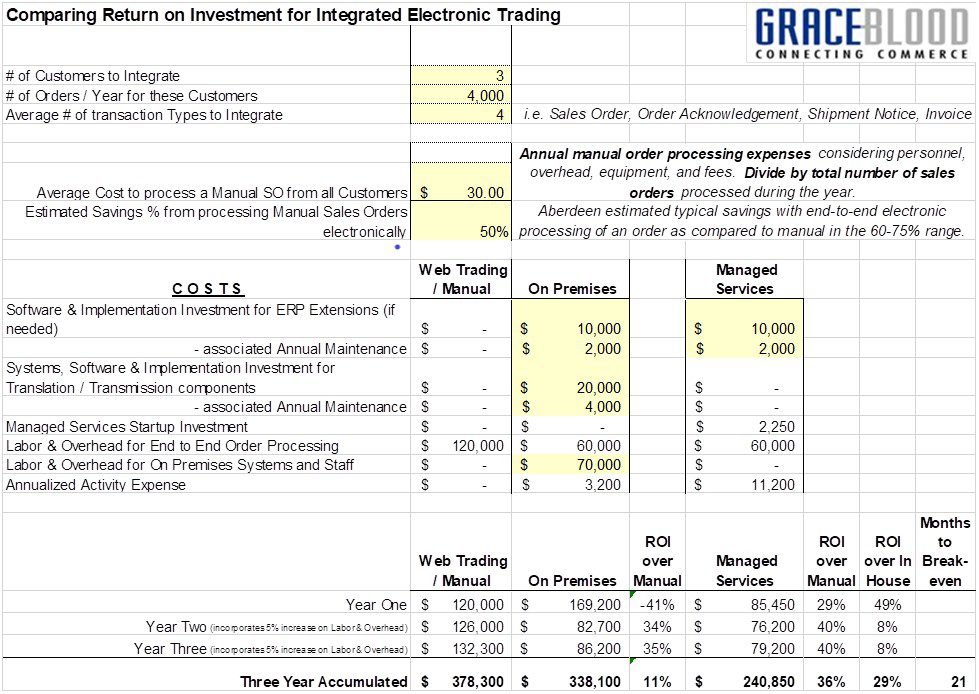

While strategic benefits can be difficult for which to calculate Return on Investment (ROI), we can easily do so for the operational benefits. For suppliers, a decision on how best to approach a mandate to retain or win the customer’s business should include careful consideration of ROI.

While many supply chain companies operate with a mix, let’s consider ROI using three approaches, one manual and two integrated:

- web-trading, where your orders are picked up, entered, acknowledged, and processed through to an invoice either manually or by visiting a website

- on-premises integrated, where your routine orders appear in your order processing system and are processed through to invoice by an intermediate system that is located and operated within your business

- cloud-based managed services also integrated and where your routine orders appear in your order processing system and are processed through to invoice through an intermediate system located in the cloud and is operating transparently

ROI may also be useful in evaluating a move from web trading to one of the integrated approaches or between them.

Let’s look at an example that you can easily tailor and use. First, we calculate our own average cost to process an order. Add up the annual manual or non-integrated order processing expenses – from receipt of order to entry, to acknowledgment, to shipping notice, to invoice – considering all personnel, overhead and equipment, and adding in any fees charged by customers for using their portal or for failing to comply with their preferred trading approach. Divide this annual total expense by the total number of sales orders processed during the year. This becomes your cost to process an average order.

Aberdeen studies have estimated typical savings with end-to-end electronic processing of an order as compared to manual in the 60-75% range. This example projects an average distributor for three customers integrating four documents over the end-to-end order to invoice process and trading 500 orders/month while conservatively projecting a 50% savings for integration over manual processing.

Click below to download a spreadsheet for use in calculating and comparing your own Return on Investment for B2B Electronic Trading. Only a few additional inputs are needed, and these are in yellow. Besides the Average Cost per Manually Processed Sales Order, count your top routine customers and determine the total # of orders you receive from them in a year. Typical transaction types of documents to integrate are the inbound Sales Order, the outbound Order Acknowledgement, Ship Notice & Invoice. Adjust If your partners don’t usually need all four.

This takes care of our Manual or Web Trading column and calculates our cost to process all the chosen customers’ orders end-to-end. For the On-Premises column, we must consider our initial investments in software and systems, as well as ongoing operational and maintenance expenses such as staff and transmission fees. These may vary based on your ERP’s capabilities and version, and your customers’ requirements. Similarly, for cloud-based Managed Services, while there may be an initial investment to augment your ERP’s capabilities, the costs for translation mapping, transport and testing are included in the Managed Services Startup Investment while activity, monitoring, maintenance and management is included in the Managed Services monthly Activity.

While ROI will vary, we can see that in addition to the perceived strategic benefits of Integrating Electronic Trading, we also can simply demonstrate and quantify an operational Return on Investment that is unique to your company. Of course, adding additional partners – a very wise step to take after initial investments – results in a multiplier effect and adds even more to your bottom line.

Get started with EDI: Speak to an expert